Postings to the control accounts in the general ledger are made _____

Content

Every organization like the UN runs on data and a set of

processes. As the level of information increases over time, data becomes

complex and difficult to manage. If data is not stored and maintained properly,

it leads to significant losses in productivity across the organization. Thus,

it is extremely critical for the organization to create a centralized data

source. Document upload is also known as a journal

voucher upload from an Excel spreadsheet.

But they also give a business other advantages, such as permitting a single trial balance to be extracted from the general ledger. If the trial balance does not actually balance, only the accounts whose control account does not reconcile need to be checked for errors. Because control accounts summarize information in subsidiary ledgers, they should always remain in balance.

One Time Entry

This activity covers the

carry forward of the fund balance from the old fiscal year to the new fiscal

year. Open

amounts in Funds Management, i.e. commitment items and purchase orders, in

local currencies must be revaluated to account for fluctuation in exchange

rates. There

is no rule in the system limiting the number of periods that can remain open

simultaneously. The only exception is MM wherein two periods are kept opened at

any one time. This

action will put the document back in workflow and other Approving Officer can

see and take action on it.

The purpose of this

process is to charge internal users of a service for the cost of that service. Each line item in the

GL, AP and AR can be cleared against completed transactions once it has been

confirmed that the data in the GL, AP and AR for the most control account recent accounting

period is accurate and complete. The Data Collection Closing comprises of

activities that ensure that all necessary accounting data generating during the

former accounting period has been collected, processed and cleared in the GL.

Chart of Accounts

If the balance is not zero, the balance must reflect cash

received by Cashier in cash or cheque that is not identified and applied to a

customer or vendor. If the balance is not zero, the balance must reflect cash

received at the bank that is not identified and applied to a customer or

vendor. The UN records accrual of expenses at year

end in order to match costs against revenue in the same financial period. The

accruals are recorded when the expenses have been incurred but invoices have

yet to be received from the vendors at year end. The GL Document workflow represents the two step process

(creator/approver) and will be used for submission, review and approval of

one-time GL entry documents.

What are postings to the general ledger?

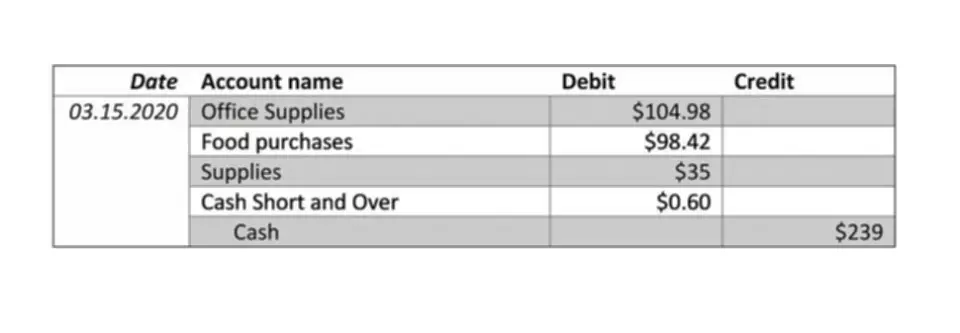

Posting to the general ledger involves recording detailed accounting transactions in the general ledger. It involves aggregating financial transactions from where they are stored in specialized ledgers and transferring the information into the general ledger.

Since the sales journal is used exclusively to record credit sales, the last column (i.e., the amount column) represents both a debit to accounts receivable and a credit to sales. The subsidiary ledger allows for tracking transactions within the control account in further detail. Individual transactions appear in both accounts, but only as https://www.bookstime.com/bookkeeping-101 an ending balance in the control account. More details such as where the money came from, who it came from and the date it was paid appear in the subsidiary ledger. If Jim had any returns or customer discounts, he would also post them in the control account to make sure that the subsidiary accounts and the control account remain in balance.

Control Account

Workflows are used to forward financial

documents for review to the appropriate approvers. Documents created by the

Financial Accounting User are subject to workflow approval before they can be

posted. Whereas Financial Accounting Senior User is able to create GL

documents, such as accruals, reversals and recurring entries that are not

subject to workflow approval. In addition, users will be

able to create and save journal entry templates that can used repeatedly to

accelerate the processing time and reduce the number of input errors.

Thus, while the „accounts receivable balance“ can report how much the company is owed, the accounts receivable subsidiary ledger can report how much is owed from each credit customer. Entries from the sales journal are posted to the accounts receivable subsidiary ledger and general ledger. Entries from the sales journal are posted to the Accounts Receivable subsidiary ledger and General Ledger.

Accrual Entry

If at any time the control account and the subsidiary ledger are not in balance, the subsidiary ledger will need to be reconciled to locate and correct the error. Control accounts are general ledger accounts that summarize lower-level activity into a single balance. Used with subsidiary accounts, your control balance should always be equal to the balance in the control account. The fundamental purpose of a control account is to aid in the detection of mistakes in subsidiary ledgers. However, they also provide additional benefits to a company, such as the ability to extract a single trial balance from the general ledger.

- A sales journal is used to record the merchandise sold on account.

- If the balance is not zero, the balance must reflect cash

received at the bank that is not identified and applied to a customer or

vendor. - Subsidiary ledgers divide

financial data into distinct and more manageable categories. - Commitment

Items used for Budget Control and Performance Reporting are derived from GL accounts. - In areas with

revenue producing activities, the Profit Center represents a product or service

line. - In Umoja, there is a one to one

relationship between a Fund Center to a Cost Center in which the Fund Center is

derived from the Cost Center.

The subsidiary ledger allows for tracking transactions within the controlling account in more detail. Individual transactions are posted both to the controlling account and the corresponding subsidiary ledger, and the totals for both are compared when preparing a trial balance to ensure accuracy. Although each transaction must be posted to the subsidiary accounts receivable ledger, only the totals for the month have to be posted to the general ledger accounts.